Imagine this scenario: you have been diligently saving for retirement for years, only to realize that you still have some lingering debt. The question arises: can you actually retire with debt? And if so, how do you effectively manage it? In this article, we will explore the answers to these crucial questions and provide you with valuable insights on how to navigate the complex realm of retiring with debt. So sit back, relax, and let’s dive into the world of managing debt in retirement.

Planning for Retirement

Determining retirement goals

planning for retirement begins with determining your retirement goals. Start by considering what you want your retirement to look like in terms of lifestyle, activities, and expenses. Do you envision traveling frequently or relaxing at home? Will you continue working part-time or fully retire? By having a clear understanding of your retirement goals, you can better define the financial resources needed to support your desired lifestyle.

Calculating retirement savings

Once you have a clear vision of your retirement goals, it’s important to calculate how much savings you will need. Consider factors such as estimated living expenses, healthcare costs, and any potential legacy or charitable contributions. Utilize retirement calculators or consult with a financial advisor to determine a target savings amount. This will serve as a benchmark for your progress and help guide your retirement planning efforts.

Considering debt in retirement planning

When planning for retirement, it is crucial to consider your debt obligations. The type and amount of debt you carry can impact your retirement savings and overall financial well-being. It’s important to understand the impact of debt on your retirement and develop strategies to manage it effectively. Let’s explore the different types of debt that may need to be considered.

Types of Debt

Mortgage debt

One of the most common types of debt carried into retirement is mortgage debt. If you still have a mortgage payment when you retire, it’s essential to factor it into your retirement budget. Consider whether downsizing, refinancing, or paying off your mortgage before retirement is a viable option for you.

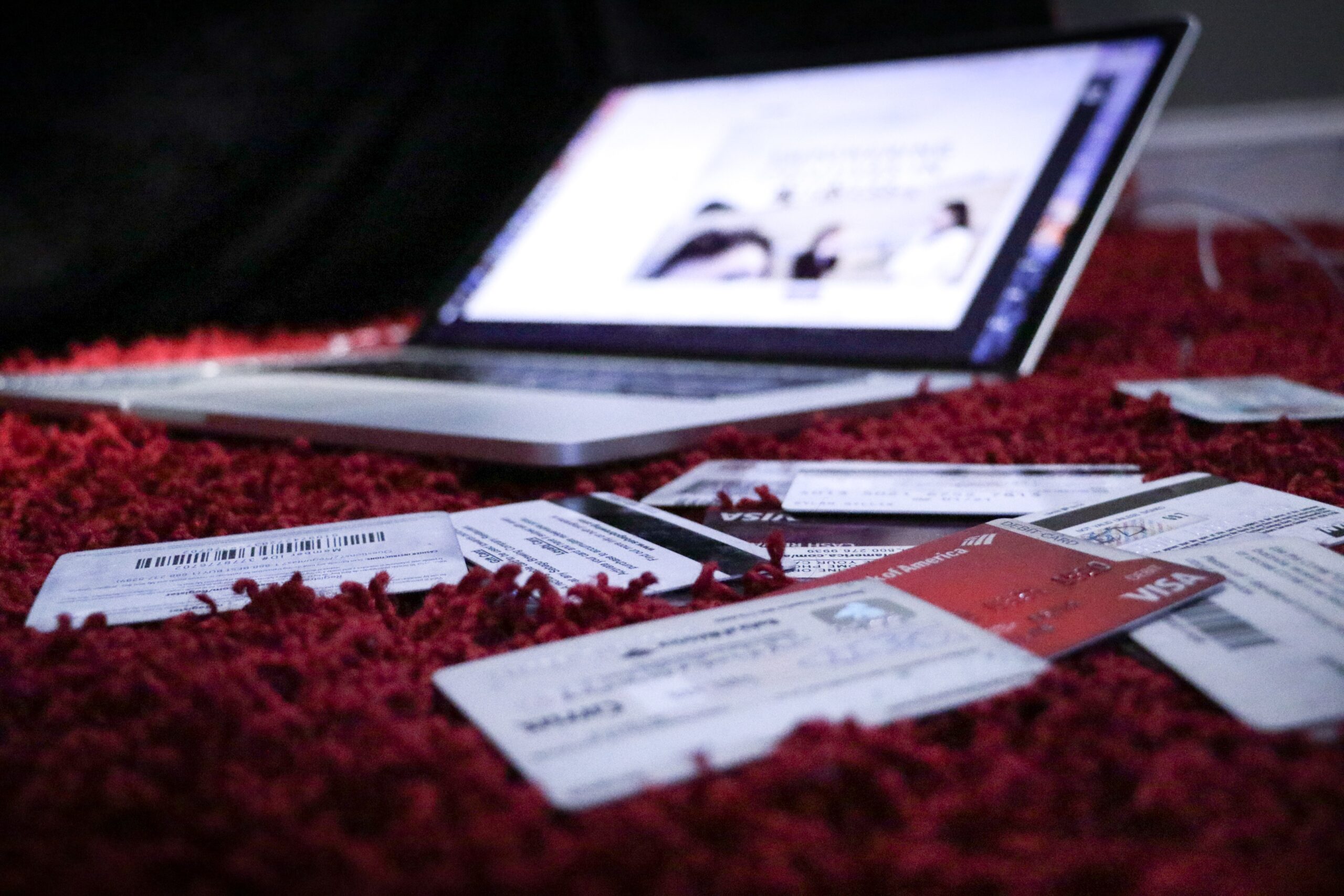

Credit card debt

Credit card debt can be a significant burden during retirement. High-interest rates and minimum payments can eat into your disposable income and impact your ability to save for retirement. It’s important to develop a plan to pay off credit card debt before retiring to avoid unnecessary financial stress.

Student loan debt

For individuals with student loan debt, it’s crucial to understand the repayment options available and the potential impact on your retirement savings. Consider exploring loan forgiveness programs, income-driven repayment plans, or refinancing options to manage your student loan debt effectively.

Auto loan debt

Auto loan debt can be another financial obligation to consider when planning for retirement. Evaluate whether downsizing or paying off your auto loan early is feasible, as it can help reduce your overall debt burden and free up more cash flow for retirement savings.

The Impact of Debt on Retirement

Reduced disposable income

Carrying debt into retirement can result in reduced disposable income. Monthly payments on loans and credit cards can limit the amount of money available for living expenses, travel, healthcare, and other retirement goals. It’s essential to manage your debt effectively to maintain a comfortable standard of living in retirement.

Increased financial stress

Debt can create significant financial stress, especially during retirement when your income may be fixed. The worry of making monthly payments and the fear of not being able to meet financial obligations can take a toll on your emotional well-being. Minimizing or eliminating debt before retirement can help alleviate this stress and provide peace of mind.

Potential limitations in retirement lifestyle

Carrying debt into retirement can limit your ability to enjoy the retirement lifestyle you desire. Higher monthly payments can restrict your options for travel, hobbies, and other activities. By managing your debt wisely, you can ensure a more fulfilling and enjoyable retirement.

Managing Debt Before Retirement

Creating a budget

Creating a budget is a crucial step in managing your debt before retirement. Evaluate your income and expenses to determine where you can cut back and allocate more funds towards debt repayment. Consider using online budgeting tools or consulting with a financial advisor to help you develop an effective budgeting strategy.

Prioritizing debt repayment

Prioritizing debt repayment is essential when planning for retirement. Identify debts with the highest interest rates or the ones that carry the most significant financial burden. Focus on paying off these debts first while making minimum payments on others. This strategy helps reduce overall interest expenses and frees up more cash flow for retirement savings.

Exploring debt consolidation options

Debt consolidation can be a helpful strategy to simplify your debt management and potentially reduce interest rates. Explore options such as personal loans or balance transfer credit cards to consolidate multiple debts into a single payment. However, be cautious and ensure that the consolidation option you choose will genuinely benefit your financial situation.

Seeking professional advice

If you’re struggling with managing your debt before retirement, don’t hesitate to seek professional advice. A financial advisor or credit counselor can provide guidance tailored to your unique situation. They can help you create a personalized debt management plan and provide strategies to accelerate your path to debt freedom.

Managing Debt During Retirement

Adjusting expenses

During retirement, it may be necessary to adjust your expenses to accommodate your debt obligations. Evaluate your budget and identify areas where you can trim expenses. This may involve downsizing your home, cutting back on discretionary spending, or finding creative ways to save on everyday expenses. By making these adjustments, you can free up more funds to dedicate towards reducing your debt.

Lowering interest rates

Reducing the interest rates on your debt can provide significant financial relief during retirement. Consider negotiating with creditors or refinancing options to secure lower interest rates. This can help minimize interest expenses and accelerate your debt repayment journey.

Exploring reverse mortgage options

For homeowners who have substantial equity in their homes but need additional income during retirement, a reverse mortgage may be an option to consider. Reverse mortgages allow you to borrow against the equity in your home. However, it’s important to thoroughly research and understand the implications of a reverse mortgage before pursuing this option.

Consolidating payments

Consolidating payments can simplify your financial management during retirement. Explore options to consolidate multiple debts into a single monthly payment. By consolidating, you can streamline your payments and potentially secure lower interest rates, making it easier to manage your debt obligations.

Considering part-time employment

If you’re comfortable and able to work during retirement, consider part-time employment as a means to manage your debt. The additional income from a part-time job can help cover your debt payments and reduce the financial strain on your retirement savings. Additionally, it provides an opportunity to remain engaged and active in your community.

Benefits of Paying Off Debt Before Retirement

Reduced financial burden

Paying off your debt before retirement reduces the financial burden and allows you to enjoy a more carefree retirement. Without the weight of debt payments, you can allocate more of your savings towards personal goals, hobbies, and experiences that bring you joy.

Increased monthly cash flow

Eliminating debt before retirement increases your monthly cash flow. This gives you the flexibility to cover living expenses, healthcare costs, and unexpected emergencies without stretching your budget too thin. The extra cash flow can provide peace of mind and improve your overall quality of life during retirement.

Higher credit score

Paying off debt can positively impact your credit score. A higher credit score opens up opportunities for securing better interest rates on future loans or credit cards. It can also make it easier to qualify for other financial products or services if necessary during retirement.

Reduced stress

Debt can be a significant source of stress, especially during retirement. Paying off your debt before retiring can significantly reduce financial stress and allow you to enjoy a more relaxed and fulfilling retirement. With fewer financial worries, you can focus on the things that bring you happiness and contentment.

Risks of Carrying Debt into Retirement

Higher interest expenses

Carrying debt into retirement means continuous interest expenses. High-interest rates can eat into your retirement savings and significantly impact your cash flow. The longer you carry debt, the more interest you accumulate, which may limit your ability to enjoy your retirement fully.

Limited access to credit

As you enter retirement, access to credit may become more challenging. Lenders may be hesitant to extend credit to individuals with limited or fixed incomes. If you rely on credit for emergencies or unexpected expenses, carrying debt into retirement could hinder your ability to secure the necessary funds.

Inability to meet unexpected expenses

Retirement often comes with unexpected expenses, whether it’s home repairs, medical emergencies, or other unforeseen events. If you’re already burdened with debt, these unexpected expenses can be challenging to manage and may lead to further financial stress.

Reduced ability to enjoy retirement

Carrying debt into retirement can limit your ability to fully enjoy your retirement years. The financial strain may prevent you from pursuing activities, travel, or hobbies that you’ve always dreamed of. By addressing and managing your debt before retirement, you can create a more financially secure and fulfilling future.

Strategies to Become Debt-Free Before Retirement

Aggressively paying down debt

Being proactive and aggressive in paying down your debt is key to becoming debt-free before retirement. Consider allocating any extra income, windfalls, or bonuses towards debt repayment. By accelerating your debt payoff, you can significantly reduce your overall debt burden and reach financial freedom sooner.

Cutting unnecessary expenses

Identifying and cutting unnecessary expenses is an effective strategy to pay off debt before retirement. Analyze your spending habits and find areas where you can make sacrifices or find more cost-effective alternatives. Every dollar saved can be redirected towards debt repayment, bringing you closer to your goal of becoming debt-free.

Earning additional income

Increasing your income through additional sources can expedite your debt repayment journey. Explore part-time work, freelance opportunities, or passive income streams to supplement your retirement savings and pay down your debt faster. The extra income can make a significant difference in reaching your financial goals before retiring.

Taking advantage of debt relief programs

If your debt burden feels overwhelming, exploring debt relief programs may be beneficial. Programs such as debt management plans or debt settlement can help you negotiate with creditors, lower interest rates, and potentially reduce the total amount owed. However, it’s essential to carefully research and understand the terms and potential drawbacks of these programs before committing.

Working with Financial Professionals

Consulting with a financial advisor

Seeking advice from a financial advisor can provide valuable insight and guidance on your retirement and debt management journey. A financial advisor can analyze your unique financial situation, outline personalized strategies, and help you make informed decisions to achieve your retirement goals.

Exploring retirement planning services

Retirement planning services specialize in helping individuals navigate the complexities of retirement, including managing debt. These services can provide comprehensive guidance, tools, and resources to create a holistic retirement plan that includes debt management strategies tailored to your specific needs.

Seeking guidance from a credit counselor

Credit counselors are experts in debt management and can provide valuable assistance for individuals struggling with debt. They can help you create a feasible plan to pay off your debt, negotiate with creditors, and provide financial education to help you maintain a healthy financial future.

Taking Action to Manage Debt

Creating a debt repayment plan

Taking action to manage your debt starts with creating a debt repayment plan. Assess your current debt, understand your cash flow, and set measurable goals for paying off your debt. Develop a step-by-step plan that outlines how much you will pay towards each debt and when you aim to become debt-free. Stick to your plan and make adjustments as needed along the way.

Staying disciplined and focused

Managing debt requires discipline and focus. Stay committed to your debt repayment plan by avoiding unnecessary expenses, keeping your budget in check, and redirecting any extra income towards debt repayment. Remember your long-term goals and the ultimate reward of financial freedom in retirement.

Tracking progress

Regularly track your progress towards debt freedom. Review your debt statements, monitor your credit score, and celebrate each milestone achieved. By seeing your progress firsthand, you’ll stay motivated and committed to your debt repayment journey.

Making adjustments as needed

Life is full of unexpected twists and turns, and your financial situation may change over time. Be adaptable and make adjustments to your debt repayment plan as needed. If you encounter unforeseen challenges or opportunities, reassess your strategy and make necessary modifications to ensure you stay on track towards a debt-free retirement.

Managing debt before and during retirement is a crucial aspect of financial planning. By considering your retirement goals, understanding the impact of debt, and devising strategies to pay off debt, you can achieve a more secure and enjoyable retirement. Seek professional advice, stay disciplined, and take proactive steps towards debt freedom to pave the way for a financially stable future.